Boortmalt Carbon Bank

Boortmalt’s Verified Low-Carbon Malt programme focuses on reducing greenhouse gas (GHG) emissions in our malt production, aligning with our Science Based Targets Initiative (SBTi) goals to reduce Scope 1 and 2 emissions by 42% by FY30. This programme uses a carbon bank to manage carbon reduction efforts and issue verified low-carbon malt certificates for sale to customers, enabling them to meet their Scope 3 emission reduction targets.

Boortmalt’s decarbonisation projects result in measurable CO2e savings. These projects are independently verified, ensuring that carbon reductions are real. These savings contribute to the carbon bank, and certificates are issued based on verified reductions.

Certificates cannot be sold without also purchasing malt, i.e. the independent trading of CO2e reduction certificates is not allowed. The revenues generated from the sale of these certificates are reinvested into new decarbonisation projects that would otherwise be economically unfeasible, thereby generating additional CO2e savings and accelerating our decarbonisation efforts.

We are also focussing on scope 3 emission reductions, investing in regenerative farming practices to ensure healthier soils, increased farmer profitability and to build long-term sustainable agriculture – enabling us to achieve our goal to reduce our Scope 3 FLAG GHG emissions by 30.3% by 2030. For the time being, this initiative and the related emission reductions will be managed separately from the carbon bank.

Carbon bank structure

Scope: The carbon bank is anchored in a gate-to-gate product carbon footprint (PCF) calculation, accounting for Scope 1 emissions (direct emissions from natural gas and fuel combustion) and Scope 2 emissions (indirect emissions from procured electricity and heat), excluding Scope 3 emissions such as those from barley production or logistics.

Region: The carbon bank methodology applies to the EU+UK region, excluding the Salzgitter, Germany facility, which operates under a third-party toll manufacturing agreement. The following sites are in scope of our EU+UK carbon bank:

- Athy, Ireland

- Bury St Edmunds, UK

- Buckie, UK

- Glenesk, UK

- Knapton, UK

- Antwerp, Belgium

- Dunaújváros, Hungary

- Gembloux, Belgium

- Herent, Belgium

- Issoudun, France

- Nova Gradiska (Slavonia Slad), Croatia

- Strasbourg, France

- Swalmen, the Netherlands

- Villaverde, Spain

Our PCF calculations are in accordance with the GHG Protocol Corporate Accounting and Reporting Standard, we follow the guidelines of the GHG Protocol for Product Accounting and Reporting Standard, and our carbon bank approach is in line with the definitions and principles of ISO 22095:2020 Chain of Custody. Our methodology has been independently validated by DNV to verify alignment with these standards.

This approach allocates CO2e savings to malt produced across different sites, compared to our FY23 baseline Scope 1 and 2 GHG emissions. The savings are aggregated and linked to volumes of malt sold with low-carbon certificates, ensuring the reduction is unique and cannot be double-counted. For simplicity, we allocate 100% emission reductions to our low-carbon malt (i.e. zero emissions related to the use and purchase of energy on site), and do not offer intermediate levels of carbon intensity malt. However, our customers have the flexibility to purchase certificates for the equivalent volume of malt of their choice (up to 100%), and can thereby decide themselves what overall level of carbon intensity they reach for the overall amount of malt procured, without setting a minimum reduction level.

Carbon emissions from energy consumption are calculated using the most appropriate emission factors:

- For natural gas, we assume that there are no differences in emission factors between different locations in one country, and therefore apply one location-based emission factor per country, according to national sources.

- The emission factor of electricity depends on the supplier and we apply market-based emission factors to convert electricity into CO2e emissions (when available – otherwise we use the location-based calculation as a default).

Customers buying conventional malt, instead should use our EU+UK regional FY23 baseline PCF to calculate their Scope 3 emissions linked to malt production, not Boortmalt’s overall Group carbon footprint as shown in our annual sustainability report.

- kg CO2e per ton of malt: Our product carbon footprint (gate-to-gate, only including our Scope 1 and 2 emissions) is expressed in kg CO2e per metric ton of malt. Emissions are allocated at ‘whole site’ level, meaning that all emissions at site level will be divided by the total net malt production of that site, with no further subdivision. Furthermore, our baseline product carbon footprint is the average of all sites in scope.

- Energy and production data: CO2e calculations are based on our invoiced energy consumption data (fuel, heat and electricity), multiplied by the most relevant carbon emission factors. Energy consumption data are collected through our internal data management system. An independent verification body, DNV, has verified these energy data by comparing them against invoiced data. Malt production volume data are also collected through our internal data management system, and have been verified by DNV against the source data.

- Baseline: As baseline for our PCF calculations, we have selected our FY23 data, to be in line with our SBTi commitment baseline. Note that FY23 started on 1 July 2022 and ended on 30 June 2023. The average PCF of all sites in the EU-UK region combined is 133 kg CO2e/ton malt, and this value is considered to be our FY23 baseline carbon intensity.

- Baseline review: Our baseline will be reviewed at the end of FY30 at the latest (so that data is never older than 10 years) to reflect our ongoing decarbonisation efforts, setting a new business as usual. In case of any material change, such as a merger, acquisition or divestment, or significant changes in reporting or calculation methodologies or data sources that would affect our baseline, we will adjust our baseline PCF sooner and will remove or add any relevant CO2e savings from our carbon bank.

Boortmalt’s decarbonisation projects result in measurable CO2e savings. These projects are independently verified, ensuring that carbon reductions are real. These savings contribute to the carbon bank, and certificates are issued based on verified reductions. Savings realised by continuous improvement and energy efficiency projects are not accounted for in the carbon bank. Banked CO2e savings will remain valid for 2 years, after which they will be retired and removed from the carbon bank.

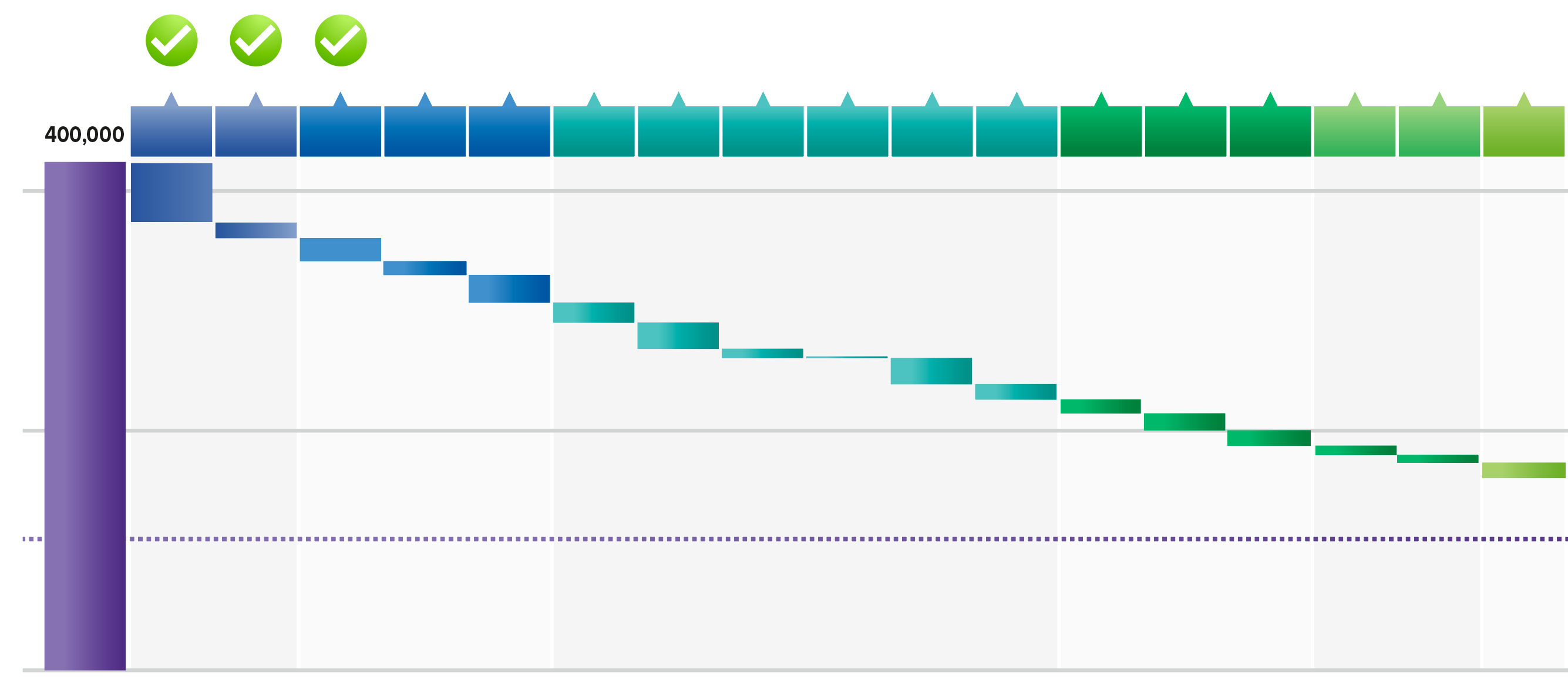

Our current (dd. 16 December 2024) decarbonisation plan for EU-UK looks like this, with FY23 baseline emissions (in ton CO2e) in blue, and realised and planned CO2e saving projects (in ton CO2e per year) in orange covering FY24 – FY30.

Governance and operational management

Banking of savings

Emission reductions from projects are banked in the carbon bank only once verified. The banked reductions are used to issue certificates to customers, allowing them to report reduced Scope 3 emissions.

Verification

An independent third party, DNV, verifies the CO2e savings and confirms that certificates are only issued when actual reductions are achieved.

Certificate generation

Certificates are only issued once sufficient CO2e savings are banked, and they are linked to the corresponding volume of malt purchased. This ensures transparency and prevents overselling of certificates. An example of how customer certificates will look like, is provided in appendix.

- Boortmalt tracks key performance indicators (KPIs) related to the carbon bank’s financial performance and the status of low-carbon malt certificates. We also manage the risks associated with underselling or overselling certificates, ensuring that the system remains balanced and financially viable.

- Internal reviews: Boortmalt has an internal team responsible for quality control, including data validation and method checks to ensure the accuracy of carbon footprint calculations and the effectiveness of the carbon bank.

- External assurance: The methodology and CO2e savings are externally verified by an independent body, DNV, ensuring compliance with industry standards and preventing double-counting of CO2e savings.

- Revenue use: Proceeds from the sale of low-carbon malt certificates are reinvested into new decarbonisation projects, driving further reductions in emissions.

- Decarbonisation initiatives: Boortmalt plans to continue electrifying its processes and exploring alternative low-carbon technologies. Our approach will adapt to changing local conditions, including energy and carbon prices, subsidies, and customer demand for sustainable products.

Customers purchasing Boortmalt low-carbon malt certificates can use these certificates to claim a reduction in their upstream value chain Scope 3 GHG emissions (on an organisational, project or product level), equivalent to the amount of certificates purchased.

The use of these certificates by the customer should be done based on the relevant standards or regulations. For further details on how to claim GHG reductions using these types of certificates, we refer to e.g. ISO 14068-1:2023.

The certificates shall not be distributed in the market, meaning that customers cannot resell their certificates a such. Customers can, on the other hand, establish their own carbon bank, based on their organisational emission baseline, and include Boortmalt’s low-carbon malt certificates into their carbon bank. This carbon bank must have third-party oversight and assurance in terms of inflow and outflow and handling of the carbon bank. Any sales from this carbon bank would be done under their own brand, with their own issued declarations and subject to their own third-party assurance process.

This summary provides an overview of Boortmalt’s carbon reduction strategy using a carbon bank system, the methodology for calculating emissions, and the management processes for verifying and issuing low-carbon certificates. The programme aims to set an industry standard and promote wider adoption of sustainable practices in the malting sector.